Resources

Information you need from people you can trust.

Tax laws seem to change frequently and it’s hard to keep up. You want to get all the deductions you can—yet, you don’t want to violate a tax law.

No one wants to be in trouble with the IRS. Tax 29 stays up-to-date with all the tax laws to make sure you don’t pay more taxes than you should.

Downloadable Resources

Basic Deduction List

Below are common deductions for many taxpayers. Every situation is different, so talk to your tax professional at Tax 29. We always help.

- Prescriptions

- Doctors, Dentists, Nurses

- Hospitals, Nursing Homes

- Insurance Premiums

- Medical Lodging and Transportation

- Medical Mileage

- Other Medical Costs

- Cash Contributions

- Non-Cash Contributions (Goodwill, Salvation army, etc.)

- Volunteer Expenses (Out of pocket mileage)

- Tuition and Fees

- Books purchased from school

- Student’s year in school

- Student loan interest paid

- Prescriptions

- Doctors, Dentists, Nurses

- Hospitals, Nursing Homes

- Insurance Premiums

- Medical Lodging and Transportation

- Medical Mileage

- Other Medical Costs

- Mortgage Interest (Includes Second Home)

- Property Tax

- Property Mortgage Insurance (post 12/2006 loans)

- Points paid on purchase

- Energy related improvements (windows, doors, furnace, A/C, Etc.)

- Personal Property tax/license fees

Miscellaneous Deductions

(Most micellaneous deductions will only apply to tax year 2017 and prior years)

- Union Dues

- Job Related Expenses

- Educator Expenses

- Investment Expense

- Investment Interest Paid

- Tax Preparation Fees

- Safe Deposit Box Rental

- Gambling Loss (To the extend of winning)

- IRA Contributions

- Alimony Paid

- Taxes Paid

- Sales tax on large purchases

- Health Savings Accounts

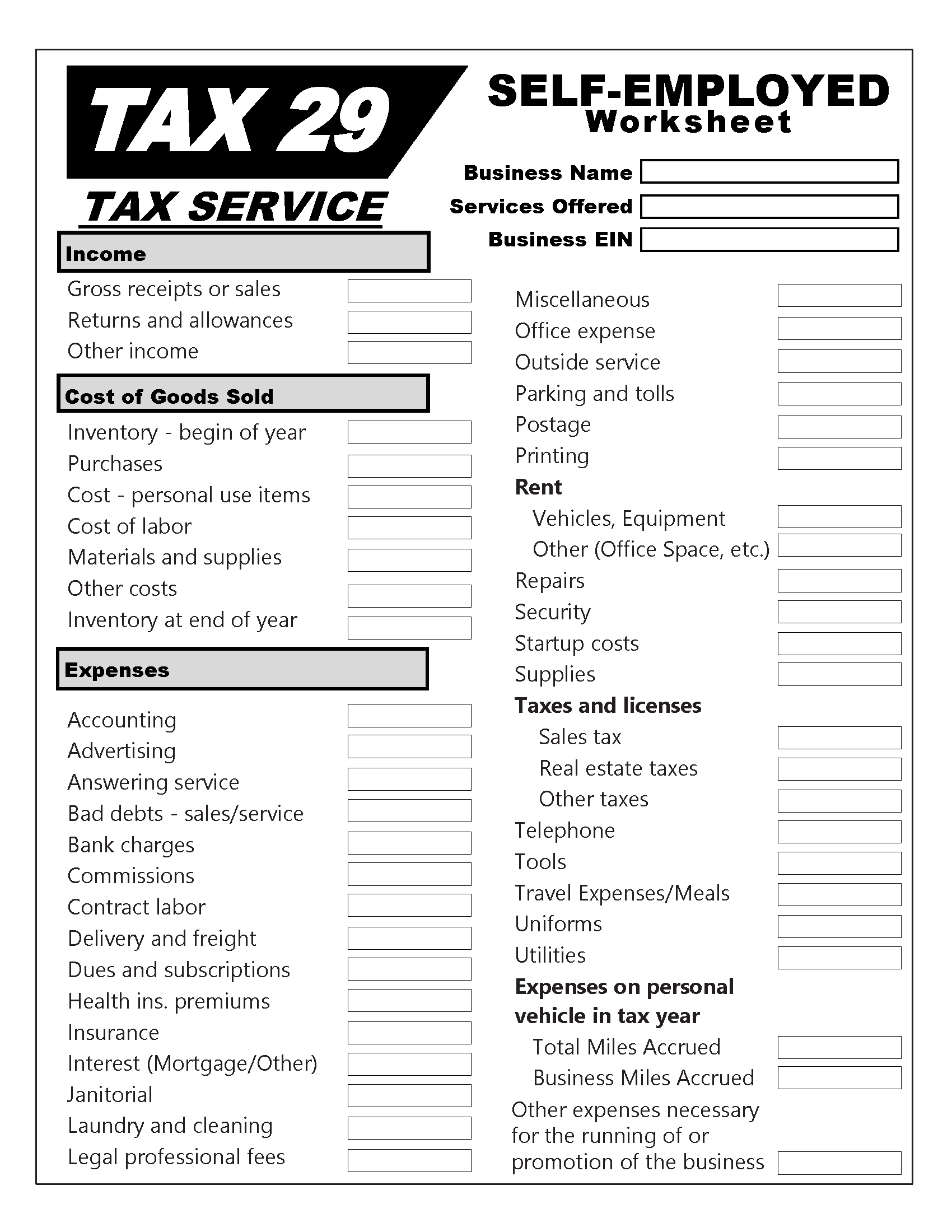

Self-Employed Deduction List

Below are common deductions for those who are self-employed. Every situation is different, so talk to your tax professional at Tax 29. We always help.

- Accounting

- Advertising

- Answering service

- Bad debts from sales or service

- Bank charges

- Commissions

- Continuing education

- Contract labor

- Delivery and freight

- Dues and subscriptions

- Health Insurance premiums

- Insurance

- Interest on business loans

- Internet

- Laundry and cleaning

- Legal and professional fees

- Meals and Entertainment

- Miscellaneous

- Office expense

- Outside service

- Parking and tolls

- Postage

- Printing

- Rent

- Vehicles

- Equipment

- Repairs

- Security

- Software

- Start up costs

- Supplies

- Taxes and licenses

- Sales tax (included in gross income)

- Real estate taxes

- Other taxes

- Telephone

- Tools

- Travel

- Uniforms

- Utilities

- Vehicle expenses

- Mileage rate or actual expenses

- Wages

- Any other expenses necessary for the running of or promotion of the business.